Business Model

Electronic Communications Network (ECN)

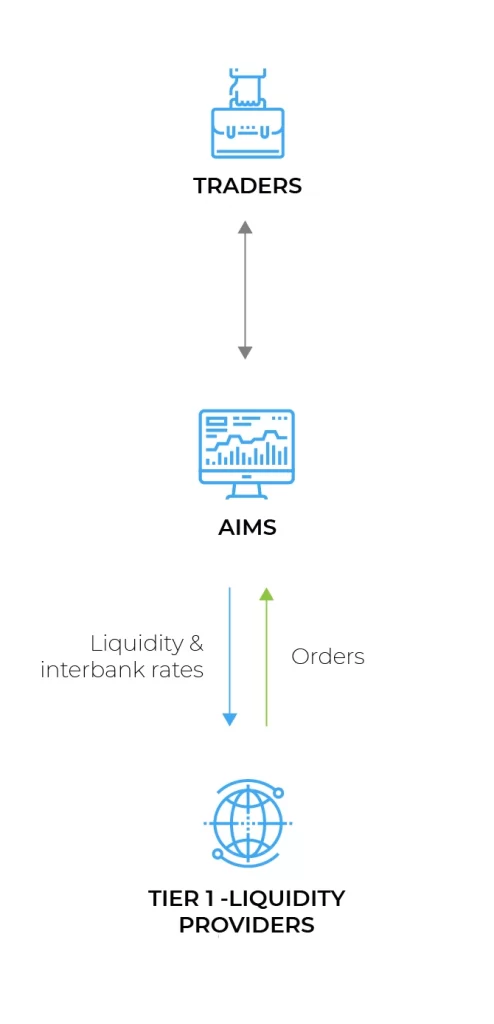

AIMS employs a non-dealing desk business model in which the Electronic Communications Network (ECN) is strictly involved.

The ECN system automatically matches clients’ buy and sell orders for securities by connecting clients directly to major brokerages and individual traders. This eliminates the need for a middleman or dealing desk to stand in-between and helps ensure clients’ orders are matched with the best available bid and ask quotes from multiple market participants.

Being part of the ECN, AIMS only earns the spread over each matched transaction. The ECN system provides both retail and institutional traders with an array of benefits, such as promoting transparent and speedy price execution, which facilitates automated trading and can be customized for passive order matching.

Straight Through Processing (STP)

AIMS STP liquidity model provides a true institutional-grade trading environment without any conflicts of interest. AIMS does not act in a principal dealer capacity. Instead, all trading volume is passed directly through to live, executable liquidity sources from leading global FX banks and first-tier liquidity providers, resulting in consistent, low-latency trade execution.

- Direct Market Access

- Straight Through Processing

Top-Tier Fund Security

Fund Safety

Over these few years of development, AIMS has grown into a globally recognized brokerage and is recognized as an exemplar of the highest standards in the financial industry.

Liquidity Providers

AIMS liquidity providers include global banks, financial institutions, and prime brokers. AIMS currently has six liquidity providers: Barclays Bank, PLC; BNP Paribas; J.P.Morgan; UBS AG; Goldman Sachs International; Credit Suisse. Our liquidity providers stream pricing through our technology and provide the best pricing to our clients.

Accounts With Top Tier Banks

AIMS provides trading feeds from top-tier banks and other world-class banking institutions to our clients.

Regulation

Punctual submission of financial statements to authorities, readiness to comply with supervisory checks, and an outstanding track record with zero complaints have allowed AIMS to earn the trust of the various regulatory boards, as well as be hailed as one of the most reliable brokerages by traders and partners worldwide.

Our Liquidity Providers